Its 2021 and the world is moving fast, so should you. If you are reading this then perhaps you are business driven. Whether a starter or about to start or have even been in the game for a while and would want to refocus and re-strategize.

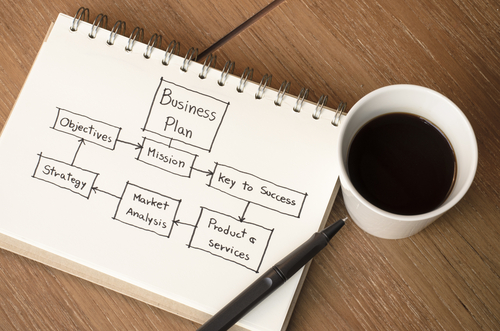

Many business plans starts as fantasies which some might call dreams. It’s good to dream but before jumping into achieving the dream, you have to sit down and count the cost which would involve or plan or some will call it, A STRATEGY.

A great business solves customer problems. First and foremost, it starts with an idea. Then you have to work with a business plan that has to convince you that your idea makes sense. Whatever business plan you decide to work with, remember your time, your money, and your effort are at stake.

A plan can be likened to a board where you create strategies filled with strategies and projections and hyperbole that will be a convincing factor to lenders or investors to show that the business makes sense, sound, reasonable and has every chance of success. It has been used by great minds even now AD to BC, till today. Every business organization and everyone still makes use of a plan.

You might be wondering why it is important to have a business plan. After all, not all successful entrepreneurs or business gurus had a business plan mapped out. They just leaped and hit the gold mine.

Well, let’s call them lucky but not everyone gets to be that lucky with an informal business plan. But what you do not know is that as this business expands, the vision expands, so it is impossible to work with the same strategy you started with, you still have to go back to the drawing board and create your map, or should I say a plan?

Majority of those who never did, had their businesses crumble. Creating a business plan helps you identify big opportunities, challenges and you may even discover issues or you had not anticipated. Without great risks but whatever you do, let your plan be as objective and logical as possible.

A good business plan should be a blueprint for a successful business. What may have seemed like a good idea for a business can, after some analysis, prove not viable with insufficient funding or unavailability of the market structure.

The fact that you are able to come up with a plan, does not necessarily mean that you will hit your goldmine but what would help you hit that mine is having a great plan with the proper help it would take to create one.

You have to thoroughly describe the development process as well as the end result. You might be wondering why you still need a plan when you have nothing to prove to anybody.

First and foremost, your business plan should convince you that your idea is not just a dream but can be a viable reality then you should try to consider these sets of people who might need to see a plan first:

Future investors and partners

Most business investors always like to see evidence of seriousness before committing to any business that would involve their money. They want to be sure the business owner is really ready to give the business all it takes and if at the end there will really be profit.

So they want to see a plan then you can then show them a proposal of where they come in only when they have been convinced. Your plan helps your investors understand all the risks that would be involve, so that if they do decide to invest, they know they were already aware.

Management team and employees

We have both the skilled and the unskilled employee out there. In most cases, the unskilled employees take any explanation you give to start a job because they know they can be replaced with better help.

When it comes to the professionals in the field, they often want to know what the business is all about. They need a plan which has your initial vision and goals if they are going to work with you to accomplish the initial vision of the business and avoid deviation of focus.

Potential sources of financing

Asides investors, there are other sources by which finance can be gotten for a start-up. Like banks, micro finance banks, local money lenders, friends and families. They often want to hear that big idea that should make them release funds to you, and you have to be as convincing as possible. There is no better way to convince them than to show them the big plan.

Potential joint ventures

A joint venture is a formal agreement between two companies or businesses for a merger of work which after its success will let both companies share the revenue and profit. No other company can share a vision they do not see. You need to show them what they are in for.

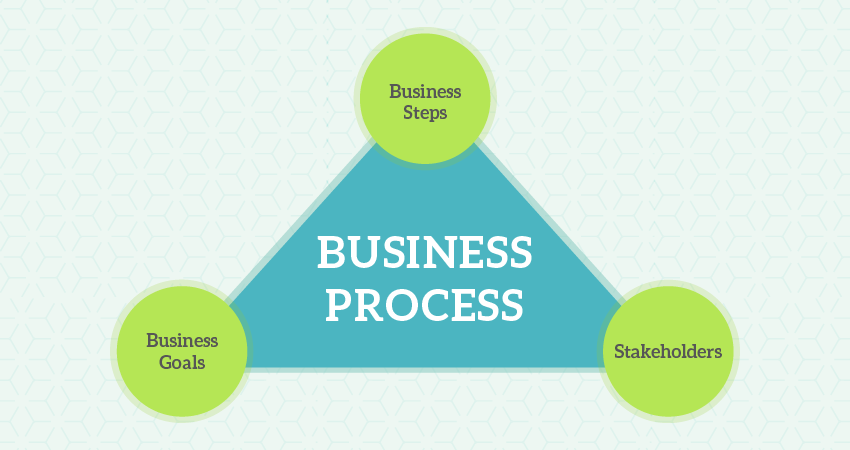

So what are the guide that would help you create that map?

Before you get down to writing out those plans, it is very necessary to try to figure out if this is something you can do by yourself. If it is not, then it is not bad seeking help from people who have succeeded in the business world or those who are professionals in the field.

It does not make you weak but only determined to be better. You can call them mentors or even teachers. Anyone that works for you. There are been cases of these teachers ending up stealing the plans of their mentees. That is why, you need to protect your plan before taking it to them

You could check out their websites and marketing materials. Most of the information you need about products, services, prices, and company objectives should be readily available.

- Create an Overview and present an Objectives for the business

In this part, you will have to answer few question probably in your business journal or on a piece of paper and Keep in mind that you need to give detailed descriptions on your overview and objectives instead of unrealistic gibberish.

What is that business idea? Write it out. Is it a product or will you be providing services instead? How do you intend to provide them? What will it cost you? Who are going to be the targeted customers?

Identify your customers and put them down. You cannot market and sell to customers until you know who they are. What are your priorities? How many employees’ skilled or semi-skilled employees (workforce capacity) will you be needing for a start (in the case of production and management?

The kind of business you plan to set up will determine the type of labour you will require. Also optional in a case of sole proprietorship)? What location (state, city, country, continent, street)? How can I be different from others operating the same business?

I know for those just starting a business, these questions can seem overwhelming but the truth is that they are very necessary to help you define your customer.

- Executive Summary

This is a brief outlined composition of the company’s purpose and goals. It can be done on one or two sheets of paper, that’s why it has to be brief. Your Summary describes should highlight your plans, critical points and important factors.

This should include a good description of products and services of the business, summary of objectives, how the business will be funded, identify your competition and determine your competitive advantage and the growth potential.

This should be outline in a way that even if handed to an investor, it helps them see into your vision with confidence that you know what you are doing.

- Financial Projections

Financial projections are usually that finances that is involved in the business. This includes the start-up capital, costs of items/equipment that will be needed. Build a financial analysis around your business.

Financial Analysis

The Financial Analysis is there to help you determine if the business projection is set to give you a profit in the market. If at the end of it all, you are going to end up have more losses than profits, then maybe you have to rethink the whole process before wasting money, time and energy on the business.

For this part, you can work with a financial accountant to help you understand what it would involve or else you already have an experience or a degree in that field.

You really do not need to be an accountant to run a business but you need to understand financial reports. If a business seeks outside funding, providing comprehensive financial reports and analysis is important.

To help with the financial analysis and projection, you are going to need to understand the importance of:

- Balance Sheet: A balance sheet is a financial statement that reports a company’s assets, liabilities and shareholders’ equity at a specific point in time, and provides a basis for computing rates of return and evaluating its capital structure. It is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. The balance sheet is used alongside other important financial statements such as the income statement and statement of cash flows in conducting fundamental analysis or calculating financial ratios.

- Cash Flow Statement: Cash Flow (CF) is the increase or decrease in the amount of money a business, institution, or individual has. In finance, the term is used to describe the amount of cash (currency) that is generated or consumed in a given time period. There are many types of CF, with various important uses for running a business and performing financial analysis.

- Operating Budget: An operating budget shows the company’s projected revenue and associated expenses for an upcoming period – usually the next year – and is often presented in an income statement format. Usually, management goes through the process of compiling the budget before the start of each year, and then makes ongoing updates each month. An operating budget might consist of a high-level summary schedule, supported by detail to back up each line item in the budget.

- Break-Even Analysis: Break-even analysis entails calculating and examining the margin of safety for an entity based on the revenues collected and associated costs. In other words, the analysis shows how many sales it takes to pay for the cost of doing business. Analyzing different price levels relating to various levels of demand, the break-even analysis determines what level of sales are necessary to cover the company’s total fixed costs. A demand-side analysis would give a seller significant insight into selling capabilities.

You need to have a detailed analysis without being biased. Any loop hole is an ingredient for future failure. There are accounting software packages which has templates and samples. You can also find templates in Excel and Google Docs.

After you have evaluated your capital needs, products or services, competition, marketing plans, and potential to make a profit, you’ll have a much better knowledge on your chances for success.

THINGS YOU SHOULD TAKE NOTE OF

- Know your targeted market

- Know the Market Needs, Understand the Market Opportunities and Marketing Strategy: Market research is critical to business success.

- Know your Competitive Advantages: study your competitor and their strategies. You can use some details to your advantage. Evaluate your competition. Research Where to get high quality equipment

- Advertisement and sign posts that would attract customers: you have to know what type of advert works for you

- Web initiatives

- Your business, depending on what type it is will be needing registration at one point.

- Understand Legal agreements, Licenses, permits, Patents, trademarks, Insurance, copyrights, Policies and procedures

- Location and Facility Management

- Website creation: Our website will attract potential visitors to the resort. We will partner with local businesses that serve our target market to provide discounts and incentives.

- Environmental or health regulations

- Breakdown of skills required

- Know the Training, Recruiting and retention

- Pay structures

You do not have to let anxiety kick in. the plan is to set a template for what you want to do, does not necessarily mean you have to achieve everything that is in there at a go. But trust me, it’s the first step to great things.

I hope I have been able to make you realize how much you really need to set a plan before taking a leap. You can make your vision come to reality and a lasting one at that. You can do it!

Are you planning to start your company now and you are thinking on what to do. First Register the company first. Click here to Register Your Business

If you enjoy this content please drop your comment below and you can also ask any question using the comment box below